We transform financial complexity into simplicity for:

Business Owners

People busy running their businesses who would like to delegate financial investment & tax decisions

Career Professionals

Working professionals who may have children and/or aging parents to plan for

Women Investors

Women who manage their wealth and the wealth of their families

Pre-Retirees

People nearing retirement who want to plan for and enjoy a rich, full life

Retirees

People already retired who want to spend their savings comfortably and confidently

Services

Investment Consulting

The starting point

We'll determine where you are financially, where you want to go and what gaps need to be filled in order to help achieve complete financial independence.

Your personal financial coach

As your coach, we'll help you think through your challenges and work collaboratively to determine and implement elegant solutions to whatever complex financial situations you're facing.

Our investment approach

We take a diversified, disciplined and long-term approach to portfolio management. Our investment portfolios are carefully designed to balance your current and future needs and goals.

Diversified and disciplined portfolios are designed to:

- Improve returns

- Reduce unnecessary risk

- Create tax-efficient income streams during retirement

Our portfolio alignment process

To help you align your investment portfolio with your life stage and financial situation, we'll conduct an in-depth:

- Performance analysis

- Risk evaluation

- Asset allocation

- Assessment of impact of costs

- Assessment of impact of taxes

- Investment policy statement

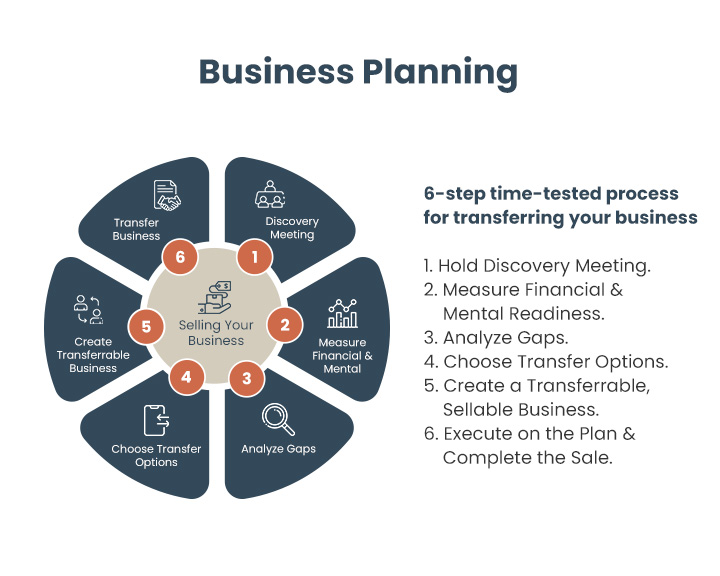

Business Planning

As a business owner, you deserve a financial advisor who specializes in the financial needs and goals of businesses. At Wasatch Wealth, we have expertise at providing financial advice for strengthening and transferring businesses.

Strengthen your business

As your business grows, financial needs change. We can help you analyze the level of risk you'll likely encounter prior to making final decisions. As a result, we can help you create and sustain a business that grows in revenue and profit.

Transfer your business

Transferring your business is one of the most complex financial transactions you'll ever navigate. Having spent years growing your business, you now have one chance to sell and transfer that business to new ownership. We have deep experience with business transfer and can provide you with a time-tested six-step process for doing just that.

Retirement Planning

Create a Plan

Ready to transition from a paycheck to retirement saving? We're here to help you do just that. Your financial life has a lot of moving parts and, when you make the transition from living off your paycheck to living off your savings, many of those parts change roles. We're here to help you align all the moving parts to create your definition of a successful retirement.

Decide what you want to do and how you want to live, then plan an investment strategy that supports that life

Your retirement plan is a living and breathing document. We use an advanced financial planning software to build your plan, track its success rate, adjust for life's unknowns, and have regular review meetings with you.

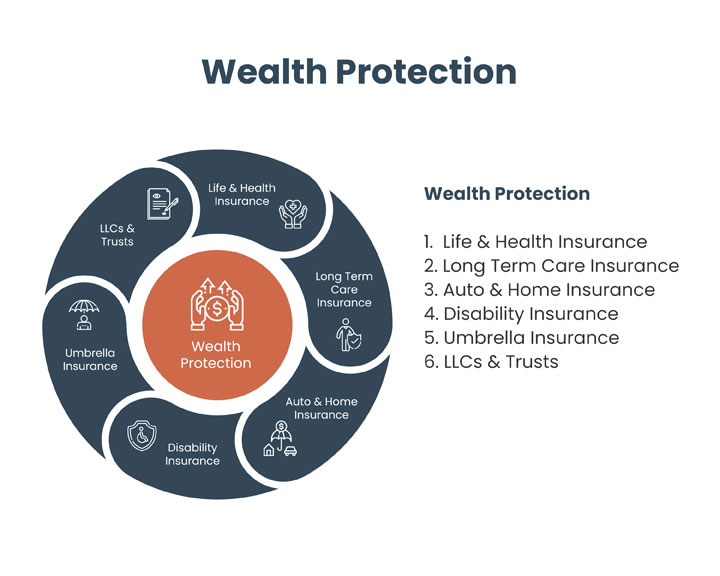

Wealth Protection

Help Maximize Protection; Lower Annual Costs

We operate as a virtual family office, which means that we have trusted professionals that will provide a neutral second opinion on how you're protecting your wealth. We can conduct an audit of existing coverage and identify any gaps you may have in the following areas:

Following the audit, we'll help you find the policies you need at the best price.

Wealth Transfer

Skillful Wealth Transfer

You've worked hard to accumulate wealth during your lifetime and you'll want to take full advantage of our decades of expertise when it comes to setting up and implementing your wealth transfer mechanisms.

We'll work with you to first clarify your values, and then develop wealth transfer strategies and transfer plans that align with your values and priorities. For example, rather than simply sending her kids to college, one client established scholarship funds that have carried her values out in the world generation after generation.

We'll help you consider strategies for:

- Multi-generational Planning

- Charitable Giving

- Integrating Wealth Transfer Mechanisms

Get the help you need to stay focused on developing and executing on your wealth transfer plans and rest assured your estate, and your loved ones, are protected.

Increase Your Money Confidence. Take Our Financial Confidence Quiz Now.

Start Quiz

The more money you have, the more complex planning becomes, which can lead to indecision and costly delays.

We work with clients to simplify complex financial situations so that they make confident, informed decisions...And use their money to live rich, fulfilling lives.

Useful Links

Contact Us

Suite 210

Bountiful, UT 84010

Phone: 801 295 7373

Toll Free: 888 995 7373

Fax: 801 295 7474